haven't done my taxes in 3 years canada

March 27 2018 Ottawa Canada Revenue Agency This year as a result of a number of new services that the Canada Revenue Agency CRA has put in place it has never been. They are very helpful and will mail you all of your T4s and any other relevant tax documents that you need.

Pin By Carmen Plemel On Nucerity S Radiant Skin Skin Radiant

Up to 15 cash back The thing is a lost my papers - Answered by a verified Canadian Tax Expert We use cookies to give you the best possible experience on our website.

. For the IRS to respect you you have to get over the halfway mark between your tax returns over your last six years. Once you file your return the CRA will adjust your tax owing to the actual balance. Yes the IRS will work with you on this but first youve got some work of your own to do.

According to Section 238 of the Income Tax Act failing to file your tax return can result in a fine of 1000 25000 and up to one year in prison. Ad Use our tax forgiveness calculator to estimate potential relief available. For example if you made less than 13229 in 2020 your income isnt taxable.

If you fail to file on time again within a three-year period that penalty goes up to 10 of unpaid taxes plus 2 per month for a maximum of 20 months. The BC corporate registry is separate from the Canada Revenue. The BC Corporate Registry.

Individuals who owe taxes for 2017 have to pay by april 30 2018. Lives in Canada 1945present Author has 267K answers and 14M answer views 3 y You should do your tax returns for the past 6 years. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Section 239 of the Income Tax. The first step in getting out of your tax mess is calling the IRS. The Canada Revenue Agencys goal is to send your refund within.

8 weeks when you file a paper return. You legally have 3 years to file income tax so no problems there - youre not in trouble or anything. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

You can do it at any time the IRS wont decline your returnbut you only have three years to file if you want to claim a refund for a tax year and the IRS might take action. I didnt file taxes for four years 2011-2014. Not filing a tax return on time is one of the most common tax problems.

The IRS estimates that 10 million people fail to file their taxes in any given year. As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late. Contact the CRA If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good.

I havent filed taxes in. 2 weeks when you file online. There are very few circumstances that excuse your obligation to file taxes in Canada.

The Canada Revenue Agency administers the Voluntary Disclosure Program which allows Canadian taxpayers to voluntarily submit late tax returns if they meet specific criteria. If you have unfiled tax. According to the cra a taxpayer has 10 years from the end of a calendar year to file an income tax return.

IRS recommends taxpayers to use only the remaining weeks to. Id go to a professional group like HR Block and have. They will want to verify who you are so.

This is because the CRA charges penalties for filing and paying taxes late. Heres what to do if you havent filed taxes in years. However if you did owe money there would be interest on it probably jot a big deal.

These timelines are only valid for returns that we received.

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Pin By K B On Arbonne Stuff Business Opportunities Quotes Opportunity Quotes Rodan And Fields Consultant

How To File A Late Tax Return In Canada

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

How Long Do You Have To Pay Back Taxes Canada Ictsd Org

Us History Lower Abs Workout Exercise Fitness Tips

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

The Penalties For Late Tax Filing 2022 Turbotax Canada Tips

Mining Adds Little Value To The Philippine Economy Philippine Economy Economy Philippine

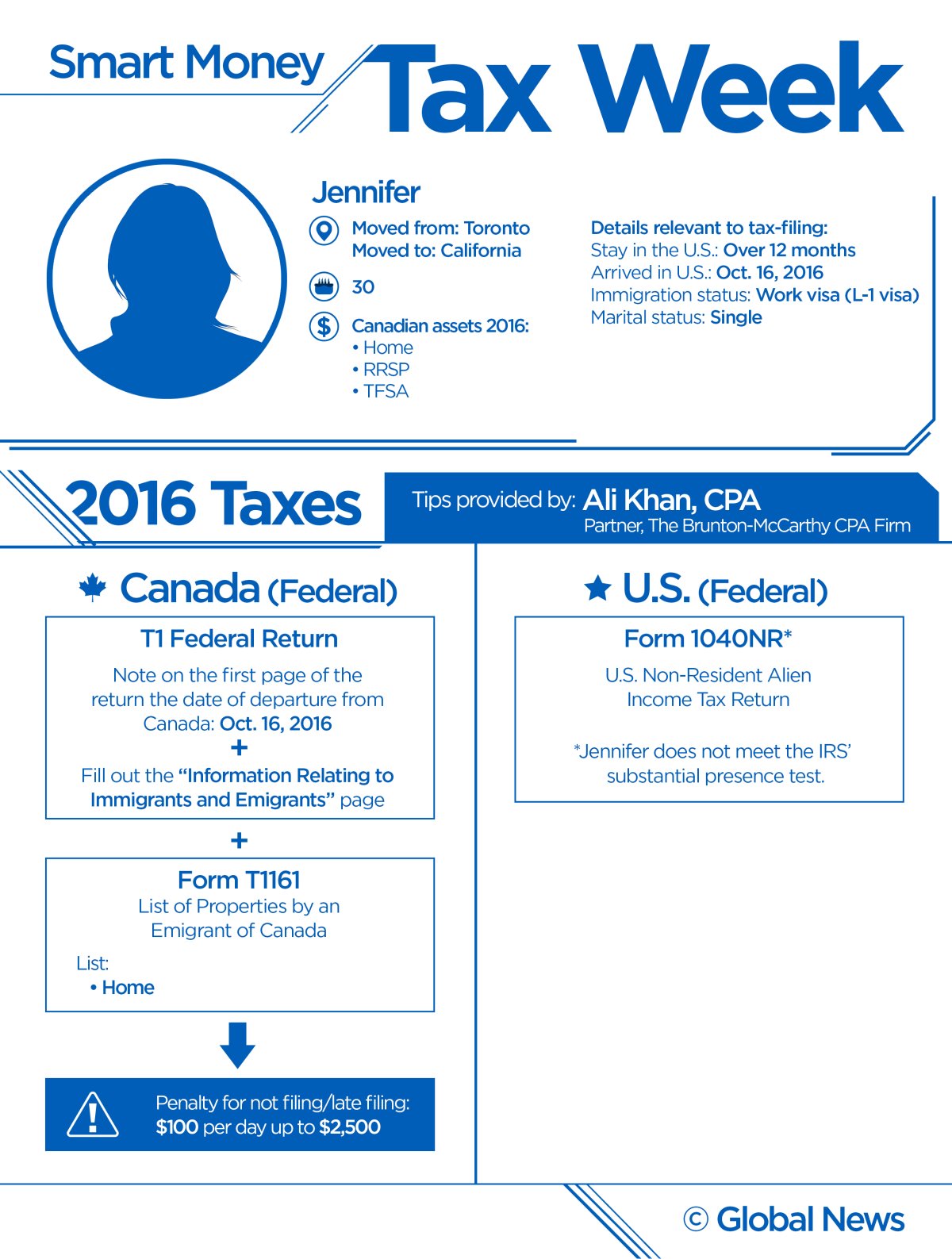

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Tax Tip Do I Have To File Taxes In Canada Every Year 2022 Turbotax Canada Tips

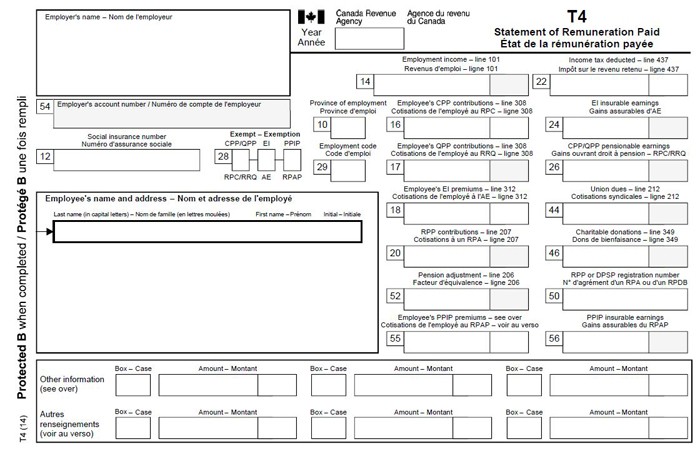

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law